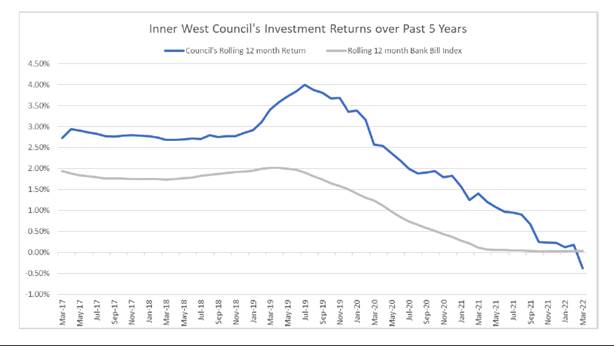

Returns since March 2017 peaked at 4% in July 2019 and have dropped to -0.5% in March 2022.

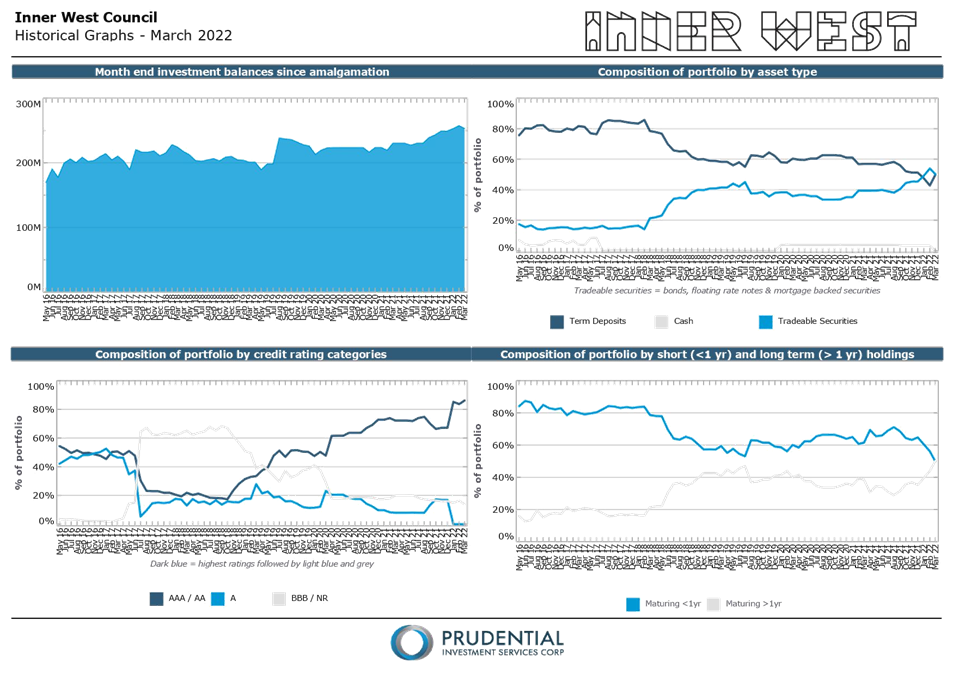

The amount invested has grown from less than $200million to over $250million.

4% of $200million = $8million

-0.5% of $250million = -$1.25million.

Investment Report on Council Agenda 10 May 2022

"Item No: C0522(1) Item 20

Subject: Investment Report at 31 March 2022

Prepared By: Daryl Jackson - Chief Financial Officer

Authorised By: Beau-Jane De Costa - Acting Director Corporate

RECOMMENDATION That Council receive and note the report.

BACKGROUND

A monthly investment report is provided to Council detailing the investment portfolio in terms of performance, percentage exposure of total portfolio, maturity date and changes in market value.

The monthly investment report includes details of the current proportion of investments that are non-fossil fuel investments and include details of progress in meeting the prevailing performance benchmark in respect of non-fossil fuel investments.

The investing of Council’s funds at the most favourable return available to it at the time whilst having due consideration of risk and security for that investment type and ensuring that its liquidity requirements are being met while exercising the power to invest, consideration is to be given to the preservation of capital, liquidity, and the return on investment.

Preservation of capital is the principal objective of the investment portfolio. Investments are placed in a manner that seeks to ensure security and safeguarding the investment portfolio. This includes managing credit and interest rate risk within identified thresholds and parameters.

Council determined to proactively invest in a non-fossil fuel investment portfolio.

Legislative Requirements

All investments are to comply with the following:

§ Local Government Act 1993;

§ Local Government (General) Regulation 2021;

§ Ministerial Investment Order dated 17 February 2011;

§ Local Government Code of Accounting Practice and Financial Reporting;

§ Australian Accounting Standards; and

§ Division of Local Government Investment Policy Guidelines May 2010

Council’s Socially Responsible Investments consist of Green Term Deposits from otherwise fossil fuel lending banks, such as CBA and Westpac and also long dated bond issues from a range of institutions and government agencies. These investments provide targeted funding to a wide range of green and socially responsible projects and initiatives. Council also utilises these investments to remain within the credit rating policy guidelines imposed by the NSW TCorp loan covenant requirements.

Council’s portfolio is in full compliance with the NSW TCorp requirements while continuing to adhere to Council’s socially responsible investment goals.

DISCUSSION

Council’s investments are held in various investment categories which are listed in the table below. Council’s investment portfolio size is $253.2m. "...

https://innerwest.infocouncil.biz/Open/2022/05/C_10052022_AGN_3943_AT_WEB.htm (viewed 12 May 2022)

Comments

Post a Comment